Working

at Operations Manager of C.S.A.Consulting was very different to my previous

employment. The company established,

administered and invested a number of superannuation funds for organizations in

Victoria.

C.S.A also offered small companies a retail superannuation fund that was

invested in accordance with the strategy selected by the members. Communication between the staff of C.S.A and

their clients, employees and executives was an important aspect of the position.

The company was very proactive in trying to develop new superannuation software to take advantage of the rapidly improving computing power of the internet. I was directly involved with Joe Benson who was in charge of Information Technology. The specifications for the new superannuation software broke new grounds and the ability of the programmer Greg Hubbard, to bring to life, the objectives specified was no mean feat. The work progressed at a steady rate, until one day, I was informed that Norwich Union Insurance was interested in buying C.S.A. Consulting for the purpose of administering the companies retail superannuation funds.

Before the move to Norwich I invited Jim Benson, Allan and Laurie and their wives to the St Thomas’ College Old Boy’s Annual Dinner Dance and I am sure that we all had a great time as the photographs below show.

In due course, the sale was completed and we all moved into the Norwich Union building in St Kilda Road. The C.S.A developed superannuation software was installed on the Norwich Union mainframe computer and we began the transfer of the company’s retail funds to the new system. Staff of Norwich Union Superannuation Division and C.S.A.staff were trained in the new system and took over the administration of the funds. The Superannuation Accounting Division of Norwich Union was given the job of recording and reporting to the Director in charge of Retail Superannuation.

When Norwich Union built a new building further down St Kilda Road, the entire Superannuation Division moved into the offices as a combined entity. This arrangement was much better than the previous, as we were physically situated on the same floor. With the added computing power of the Norwich Union mainframe computer, we now started the development of new superannuation software that would make Norwich Union a leader in this field. The main objective was the use of the internet to allow an employer to process the contributions of their employees over the internet and direct credit the funds into an appropriate bank account. Also the payment of member benefits, after the approval of the insurance agent who was looking after the client was also to transferred over the internet. Member and Employer communication and marketing was also to be available on the Norwich union website. Finally, members could check their balances via the internet and their employers could determine the position of their account and the transactions to date, virtually in real time.

This was my last hurrah for me as I had now worked in all the sectors of the superannuation industry and was privileged to have worked with a great bunch of people.

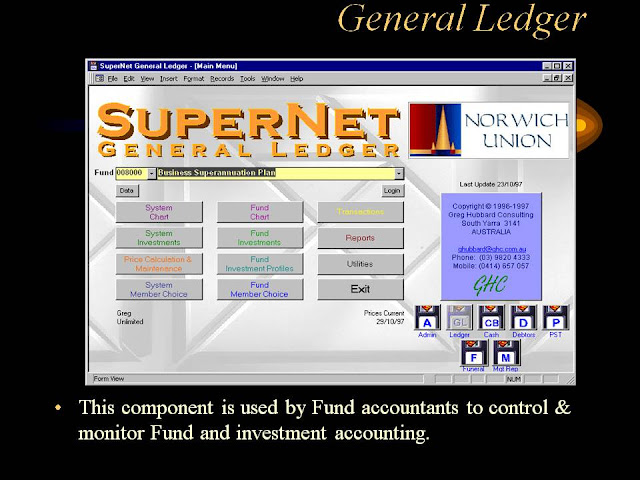

A few of the several screen prints of a power point presentation of the new system named “SuperNet” follow:-

This was the system that Joe Benson of CSA Consulting had been developing with Greg Hubbard Consulting as the principle programmer.

The Internet was in it’s infancy and this system would use the future power of the internet to reduce administration costs and enhance the communication between the participants of the various retain superannuation funds in Norwich Insurance.

The integration of member and employer records with contribution income, investment income and benefit payments, advisor payments, etc with a general ledger made a dramatic improvement in financial reporting to all parties.

Employers, members, advisors and Norwich Staff now could log into the system at various levels and receive real time information.

I continued my consulting work at Norwich Union and assisted in the completion of the on- line superannuation system named “Supernet”.

After a Consultant review of the operations of the Superannuation Division of Norwich Union, the Company Directors decided to CSA Consulting back to its former directors and the personnel who were previously employed by CSA and had transferred to Norwich Union, moved to a new office premises in St Kilda Road. As I had planned to resign at the end of 1999, I stayed with Norwich Union and with the agreement of the Director in charge of superannuation, consulted to both Norwich Union and CSA until the end of December 1999.

I received an invitation to have lunch with the Ms Trish Kelly, Director who was responsible for Superannuation and much to my surprise during the lunch was offered the position of General Manager of the Norwich Union Superannuation Division. I was flattered, but as we had started building our houses on the River Road, Yarrawonga property, gracefully declined, telling her that I appreciated the confidence she had in my ability, but at the age of 59 and planning to move within the next year, I thought that there were other people who were worthy candidates for the position.

During the period that I free lanced, Greg Hubbard talked to me about a computer system that he was involved in developing for people who had self managed funds and we thought that the system was robust enough to sell to the public.

After testing the system I was confident that we could try and market it via retailers such as “OfficeWorks” and “Harvey Norman”. Discussions with representatives of these companies were positive, so we had a number of CD’s burnt and a presentation box made.

Screen prints of an “Investor 98” power point presentation follow:-

When I was working at the Australian Retirement Fund, good friends of mine Michael Sebel and Mohan De Run suggested we stay at their apartment in Yarrawonga, the next time I had to visit an employer in Northeast Victoria. When an opportunity arose, Ruth came with me and we spent a week-end in Yarrawonga.

|

|

From then on we spent most school holidays staying at the Boatel Apartments. During this period we decided to retire to Yarrawonga, where we had spent many a very happy holiday. We first met Michelle O’Meara who showed us several properties in Yarrawonga and Mulwala and I was keen on a property in Mulwala with absolute lake frontage, but Ruth was not keen on the location due to the very young grand-children. We later approached Rod Leslie, the principle of Elders Real Estate in Yarrawonga and he advised us that there was to be an auction of two blocks of land on River Road in Yarrawonga. As this was the premier address in town we made sure we were there on auction day. We stayed at Corowa for the week-end and drove to Yarrawonga on the day. To cut a long story short, we ended up buying the property known as 1 River Road, Yarrawonga and as there were no bids on 3 River Road, were offered first refusal at the same price, but declined as at that time we did not have the funds for such an investment. After the auction, we asked Rod Leslie whether he knew of any builders in the region who could build us our house. He recommended a builder by the name of Gary Freeman. On returning to Melbourne, we contacted Gary on the mobile phone number given to us and arranged to meet him the next time we were in Yarrawonga. Several weeks later, we met Gary the site of a house that he was building a house for Nat Leslie and her husband, who was going to same church (St Cuthbert’s Anglican Church) that we would be attending. We decided to sub-divide the land and build two houses on the corner block as the income from the second house would be helpful in the future. The two houses were designed and Gary Freeman gave us quotes that were within our budget and we entered into contracts for their construction.

Unlike

by 50th which was attended by all my staff at the Transport/SERB

Funds and others who I had met during my time at the Housing Commission, the

State Superannuation Fund and the Construction Industry long Service Leave

Fund, my 60th birthday party was more a farewell to Melbourne than a retirement

party. It was a low key affair and I am glad that John Hope who was my first

Chairman at the Australian Retirement Fund could attend. The garden party was a

great success.

We had

sold the Chirnside

Park house just before

the party and settlement was in the middle of January 2000, which fitted in

with our plans. The following pages are pictures of my 60th Birthday

and the Roseman Road,

Chirnside Park house.

Roseman Road , Chirnside Park Garden Party